CBSE Class 12 Accountancy Sample Paper 2022-23

CBSE Class 12 Accountancy Sample Paper 2022-23: Read below to view and download CBSE Class 12 Accountancy Pre Board sample paper pdf and marking scheme pdf for board exams.

CBSE Class 12 Accountancy Sample Question Paper 2022-23

CBSE Class 12 Accountancy Sample Papers are Released by CBSE. Class 12 students can practice these CBSE Accountancy Sample Papers to prepare for their board exams. CBSE Teachers and Students can also download the CBSE Accountancy Sample Papers for Class 12 PDF.

The CBSE Class 12 Accountancy Sample Question Papers included questions from the syllabus in the same exam pattern that is for Class 12 pre-board Accountancy sample question papers.

General Instructions:

This question paper contains 34 questions. All questions are compulsory.

This question paper is divided into two parts, Part A and B.

Part – A is compulsory for all candidates.

Part – B. (i) Analysis of Financial Statements

Question 1 to 16 and 27 to 30 carries 1 mark each.

Questions 17 to 20, 31and 32 carries 3 marks each.

Questions from 21 ,22 and 33 carries 4 marks each

Questions from 23 to 26 and 34 carries 6 marks each

PART A (Accounting for Partnership Firms and Companies)

S.NO QUESTIONS MARK 1 – Maximum Marks: 80

1 Ajit and Sujit are partners running a garments business. To expand their business they decided to admit Rohit for 1/5th share of profits. The journal entry for adjustment of the General Reserve was as follows:

The new profit-sharing ratio of Ajit, Sujit, and Rohit will be:

(a) 17:7:6 (b) 8:4:3 (c) 2:1:2 (d) 5:3:2

2. Assertion (A): Rent payable to a partner is debited to Profit & Loss Account and not debited to Profit and Loss Appropriation Account.

Reason (R ): Rent payable to partner is a charge against profit and not an appropriation of profit.

a) (A) is correct but (R) is wrong

b) Both(A)and(R) are correct, but (R) is not the correct explanation of (A)

c) Both (A) and (R) are incorrect. d)Both (A) and (R) are correct, and (R) is

the correct explanation of (A)

3. A company forfeited 4,000 shares of `Rs10 each on which application money of `Rs 3 has been paid. Out of these 2,000 shares were reissued as fully paid up and `Rs 2,000 has been transferred to capital reserve.

Calculate the rate at which these shares were reissued.

a) Rs 10 b) Rs 9 c) Rs 11 d) Rs 8

OR When debentures are issued at discount but redeemable at par, which of the following account will be debited at the time of issue

a) Discount on issue of debentures a/c

b) Premium on redemption of debentures a/c

c) Security Premium Reserve d) Profit and Loss a/c.

4. X, Y, and Z are partners in a firm sharing profits in the ratio of 3 : 2 : 1. They decided to share future profits equally. The Profit and Loss Account showed a Credit balance of ₹60,000 and a General Reserve of ₹30,000. If these are not to be shown in the balance sheet, in the journal entry :

(A) Cr. X by ₹15,000: Dr. Z by ₹15,000

(B) Dr. X by ₹15,000; Cr. Z by ₹15,000

(C) Cr. X by ₹45,000; Cr. Y by ₹30,000; Cr. Z by ₹15,000 (D) Cr. X by ₹30,000; Cr. Y by ₹30,000; Cr. Z by ₹30,000

OR Sharma and Verma were partners in a firm. They wanted to admit two more members to the firm. list the categories of individuals other than minors who cannot be admitted by them.

5. A firm earns Rs1,10,000.The normal rate of return is 10%. The assets of the firm amounted to Rs11,00,000 and liabilities to Rs1,00,000. Value of goodwill by capitalisation of average actual profit will be:

(a) Rs 2,00,000 (b) Rs 5,000 (c) Rs 10,000 (d) Rs 1,00,000

6. Ashima Ltd. issued 50,000, 8% Debentures of ₹ 100 each at certain rate of premium and to be redeemed at 10% premium. At the time of writing off Loss on Issue of Debentures, Statement of Profit and Loss was debited with ₹ 3,00,000. At what rate of premium, these debentures were issued?

a) 10% b) 16% c) 6% d) 4%

OR Smita Ltd. issued 80,000, 10% Debentures of ₹ 100 each at certain rate of discount and were to be redeemed at 20% premium. Existing balance of Securities Premium before issuing of these debentures was ₹ 25,00,000 and after writing off Loss on Issue of Debentures, the balance in Securities Premiumwas ₹ 1,00,000. At what rate of discount, these debentures were issued?

a) 10% b) 5% c) 25% d) 15%

7. Dinesh Ltd, issued a prospectus inviting applications for 15,000 shares of ₹10 each payable ₹3 on application, ₹5 on allotment and balance on call. Publichad applied for certain number of shares and application money was received. Which of the following application money, if received restricts the company to proceed with the allotment of shares, as per SEBI guidelines?

a) ₹ 36,000 b) ₹ 45,000 c) ₹ 50,000 d) ₹ 40500

8. Anil and Sunil are partners in a firm. Anil advanced a loan of Rs. 50,000 @12% p.a. on 31st December 2019. For the year ending 31st March 2020, the firm incurs a loss of Rs. 40,000, Before charging interest on the loan. What amount of profit or loss will be transferred to partners?

A). 38500 B) 40,000 C) 41500 D) no amount

OR X, Y, and Z are partners in a firm. At the time of division of profit for the year, there was dispute between the partners. Profit before interest on partner’s capital was ₹6,00,000 and Z demanded minimum profit of ₹5,00,000 as his financial position was not good. However, there was no written agreement on this point.

(A) Other partners will pay Z the minimum profit and will share the loss equally. (B) Other partners will pay Z the minimum profit and will share the loss in capital ratio.

(C) X and T will take ₹50,000 each and Z will take ₹5,00,000. (D) ₹2,00,000 to each of the partners.

Read the following case and answer Q.No. 9 and 10:

A and B are partners with capitals of Rs.10,00,000 and Rs. 6,00,000 respectively. Interest on Capital is agreed @5% p.a. B is to be allowed a salary of Rs. 10,000 per month. During the year 2020-21, the profits prior to the calculation of interest on capital but after charging B’s salary amounted to Rs. 3,00,000. Manager is to be allowed a commission of 5% of the net profit after charging such commission.

Based on the above information you are required to answer the following questions:

9. Manger’s commission will be recorded:

a) in the Profit & Loss Account

b) in Profit & Loss Appropriation Account c) in Revaluation Account

d) in Realization Account

10. Net Profit before charging Manager Commission is 2,20,000. Manager commission is 10% of net profit after charging such commission. The manager’s commission amounted to be:

a) 22,000 b) 20,000 c)8571 d)16,190

11. Amit, Sumit, and Punit are partners in a firm sharing profits in the ratio of 3:2:1. Sumit is guaranteed a minimum profit of ₹ 20,000. Net Profit for the year is ₹ 45,000. The deficiency of Sumit’s profit would be:

a) ₹ 15,000 b) ₹ 5,000 c) ₹ 10,000 d) ₹ 20,000

12. A company issued 60,000 shares of Rs. 50 each. The amount to be paid is Rs. 15 on the application, Rs. 20 on the allotment, Rs. 5 on the first call, and the balance on the final call. The final call is not yet made. The company forfeited 1200 shares for nonpayment of first call money. On the forfeiture of shares the share capital account will be:

a) debited by Rs.48,000 b) debited by Rs. 60,000 c) credited by Rs.48,000 d) credited by Rs.60,000

13. Security Premium can not be used for

A. Issue of fully paid bonus shares B. Writing of preliminary expenses C. Buying back of shares D. Issue of partly paid bonus share

14. In PK Ltd., P and K are partners sharing profits in the ratio of 3:2. R is admitted for 1/5th share and he brings in Rs. 1,68,000 as his share of goodwill which is credited to the capital accounts of P and K respectively with Rs. 1,26,000 and Rs. 42,000. The new profit-sharing ratio will be:

a) 3:1:5 b) 3:2:5 c) 9:7:4 d) 7:9:4

15. A and B are partners. A draws a fixed amount at the beginning of every month. Interest on drawings is charged @8% p.a. At the end of the year interest on A’s drawings amounts to ₹ 2,600. Monthly drawings of A were:

a) ₹ 8,000 b) ₹ 60,000 c) ₹ 7,000 d) ₹5,000

OR Vidyadhar, a partner withdrew ₹ 5,000 at the beginning of each quarter, and interest on drawings was calculated as ₹ 1,500 at the end of the accounting year 31 March 2022. What is the rate of interest on drawings charged?

a) 6% p.a. b) 8% p.a. c) 10% p.a. d) 12% p.a.

16. On dissolution of a firm, its Balance Sheet revealed total creditors ₹50,000; Total Capital ₹48,000; Cash Balance ₹3,000. Its assets were realized at 12% less. Loss on realization will be :

(A) ₹6,000 (B) ₹11,760 (C) ₹11,400 (D) ₹3,600

17. Ajay, Vijay and Pranjal are partners in a firm sharing profits and losses in the ratio of 5:3:2. Their books are closed on 31st March every year. Ajay died on September 30th, 2019.

His executors were entitled to : His share of profit up to his date of death on the basis of sales till date of death. Sales for the year ended 31st March, 2019 was ₹ 2,00,000 and profit for the same year was 10% on sales. Sales shows a growth trend of 20% and percentage of profit earnings is reduced by 1%. Journalise the transaction along with the working notes.

18. Pratap, Ram and Shyam are partners in a firm sharing profits and losses in the ratio 5:3:2. Shyam is given a guaranteed profit of Rs. 30,000 irrespective of his actual share. Any deficiency due to this arrangement is borne by Pratap and Ram equally. During the year 2021-22, the net profit of the firm was Rs. 1,40,000. Show the distribution of profit among the partners

OR

Kashvi, Bharti and Vidhi are partners in a firm sharing profits and losses in the ratio 3:3:2. On 1st April 2021 their capital balances stood at Rs. 90,000 Rs. 80,000 and Rs. 70,000 respectively. The partnership deed provides interest on capital at 12% p.a. During the year 2021-22, the Net Profit of the firm was Rs. 1,20,000 distributed equally among the partners without providing interest on capital. You are required to pass an adjustment journal entry to rectify the errors. Show your working

19. Anubhav Ltd took over assets of Rs 8,40,000 and liabilities of Rs.80,000 of Sahil Ltd at an agreed value of Rs.7,20,000. Anubhav Ltd paid to Sahil Ltd by issue of 9% Debentures of Rs.100 each at a premium of 20%.Pass the necessary journal entries to record the above transactions in the books of Anubhav Ltd.

OR R Ltd. purchased a running business from P Ltd for a sum of Rs.12,00,000 payable by issue of equity shares of Rs.10 each at a premium of Rs. 2 per share.

The Assets and liabilities were the following:

| Plant | 4,00,000 |

| Furniture | 2,00,000 |

| Building | 4,00,000 |

| Stock | 3,00,000 |

| Sundry Creditors | 1,00,000 |

Record necessary Journal entries in the books of R Ltd.

20. A, B and C are partners sharing profits and losses equally. They agree to admit D for equal share. For this purpose goodwill is to be valued at 3 years’ purchase of average profits of last 5 years which were as follows:

| Year ending on 31-3-2018 | 60,000 (profit) |

| Year ending on 31-3-2019 | 1,50,000 (profit) |

| Year ending on 31-3-2020 | 20,000 (Loss) |

| Year ending on 31-3-2021 | 2,00,000 (profit) |

| Year ending on 31-3-2022 | 1,85,000 (profit) |

On 1st October 2021 a computer costing Rs. 40,000 was purchased and debited to the office expenses account on which depreciation is to be charged @25% p.a. by Straight line method. Calculate the value of goodwill. Also, pass the journal entry for treatment of Goodwill at the time of admission of D’s admission.

21. On 1st April 2022, Shivani Ltd was registered with share capital of Rs 10,00,000 divided into 1,00,000 equity shares of Rs10 each. The company issued prospectus inviting applicants for 90,000 Equity shares.

The company received applications for 85000 shares. During the first year, Rs 8 per share was called. Rati holding 1000 shares and Arti holding 2000 shares did not pay first call of Rs 2 per share. Arti’s shares were forfeited and later on 1500 shares were reissued at Rs 6 per share, 8 called up. Show how ‘Share capital’ will be disclosed in the balance sheet as per schedule III of Companies act 2013. Also prepare Notes to Accounts.

22. Give necessary Journal Entries for the following transactions on the dissolution of the firm of Savi and Diya on 31st March, 2022 after various assets (other than cash) and third-party liabilities have been transferred to Realisation Account. They shared profit and losses in the ratio of 3:2.

a) Amit, an old customer whose account for Rs. 60,000 was written off as bad debt in the previous year, paid 90%.

b) creditors of Rs. 40,000, accepted furniture valued at Rs. 38,000 in full settlement of their claim.

c) Land and Building was sold for Rs. 3,00,000 through a broker who charged 2% commission.

d) Profit on Realization was Rs. 45,000.

23. X ltd invited applications for issuing 2,00,000 Equity shares of Rs 10 each at premium of Rs 3 per share. The amount was payable as follows-

On Application and Allotment-= Rs 8 per share (including premium)

On the First and final call- Balance

Applications were received for 3,00,000 shares. Applications of 50,000 shares were rejected and money was refunded. Shares were allotted on a pro-rata basis to the remaining applicants.

First and final call was made and received except on 2500 shares applied by Kanwar. His shares were forfeited. The forfeited shares were reissued at Rs 7 per share fully paid up. Journalise

OR Pass the journal entries for forfeiture and re-issue of shares in both the following Cases:-

(a) Janata Ltd. forfeited 1,500 shares of Rs. 10 each at a premium of Rs. 2 each due to non- payment of First call of Rs. 3. The final call of Rs. 2 is not yet made. Out of these 900 shares were re-issued at Rs. 6, Rs. 8 called up.

(b) Aakash Ltd. forfeited 5,000 shares of Rs. 10 each (issued at Rs. 2 premium) for non- payment of first call of Rs. 2 per share. Final call of Rs. 3 per share was not yet made. Out of these 2,000 shares were re-issued at Rs. 10 per share as fully paid.

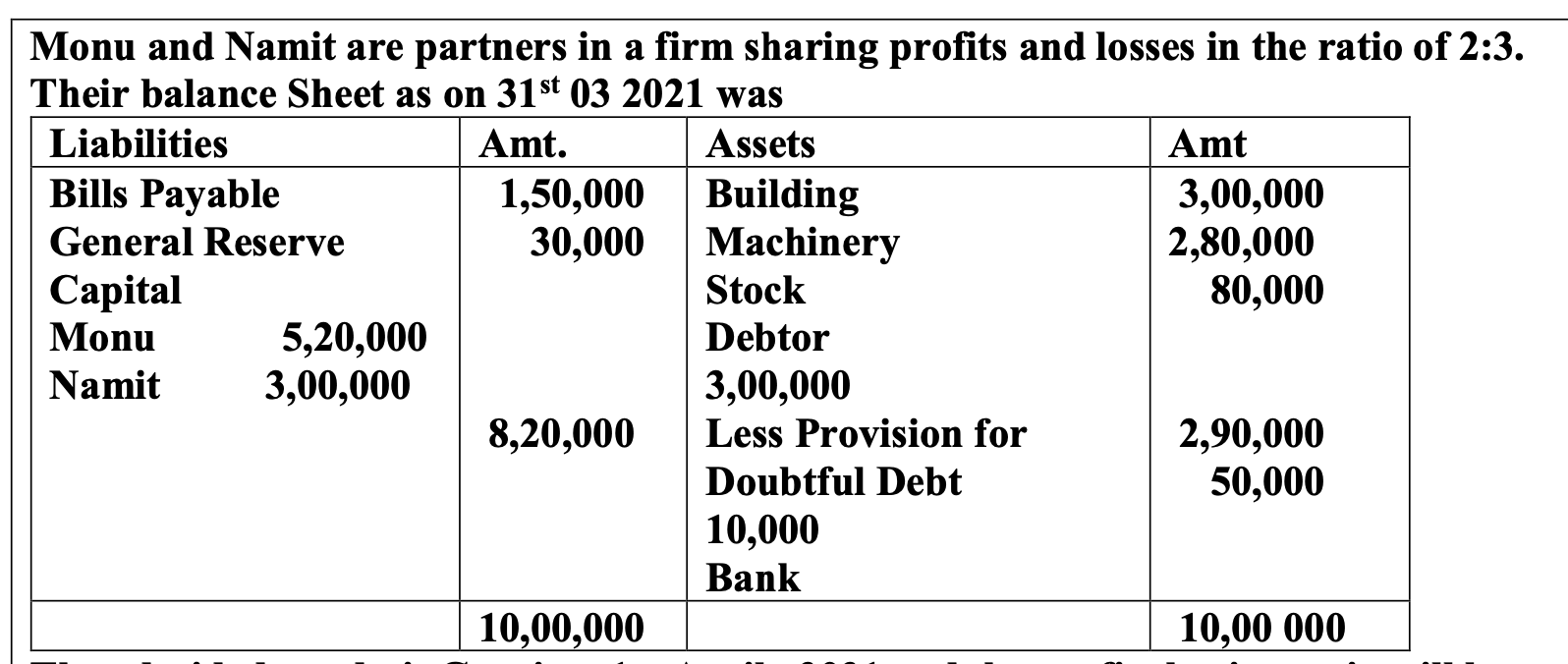

On the above date X retired from the firm on the following conditions:

- The goodwill of the firm is valued at Rs. 3,00,000.

- Write off bad debts amounting to Rs.15,000.

- Depreciate furniture by 25%.

- Other fixed assets revalued at Rs. 2,40,000.

- Capital of the new firm after X’s retirement was fixed at Rs. 1,50,000. It was also decided to re-adjust the capital in new ratio by opening current account.

Prepare the Revaluation account and Partners’ capital account. or

They decided to admit Gauri on 1st April , 2021 and the profit sharing ratio will be 2:3:5

Gauri brings Rs 4,00,000 as her capital and her share of goodwill. Goodwill of the firm is valued at Rs, 3,00,000

The building was found undervalued by Rs. 26,000

Provision for Doubtful Debt to be made equal to 5% of the debtors. There was a claim of Rs. 6,000 on account of workmen compensation Preparer revaluation account and partners capital account

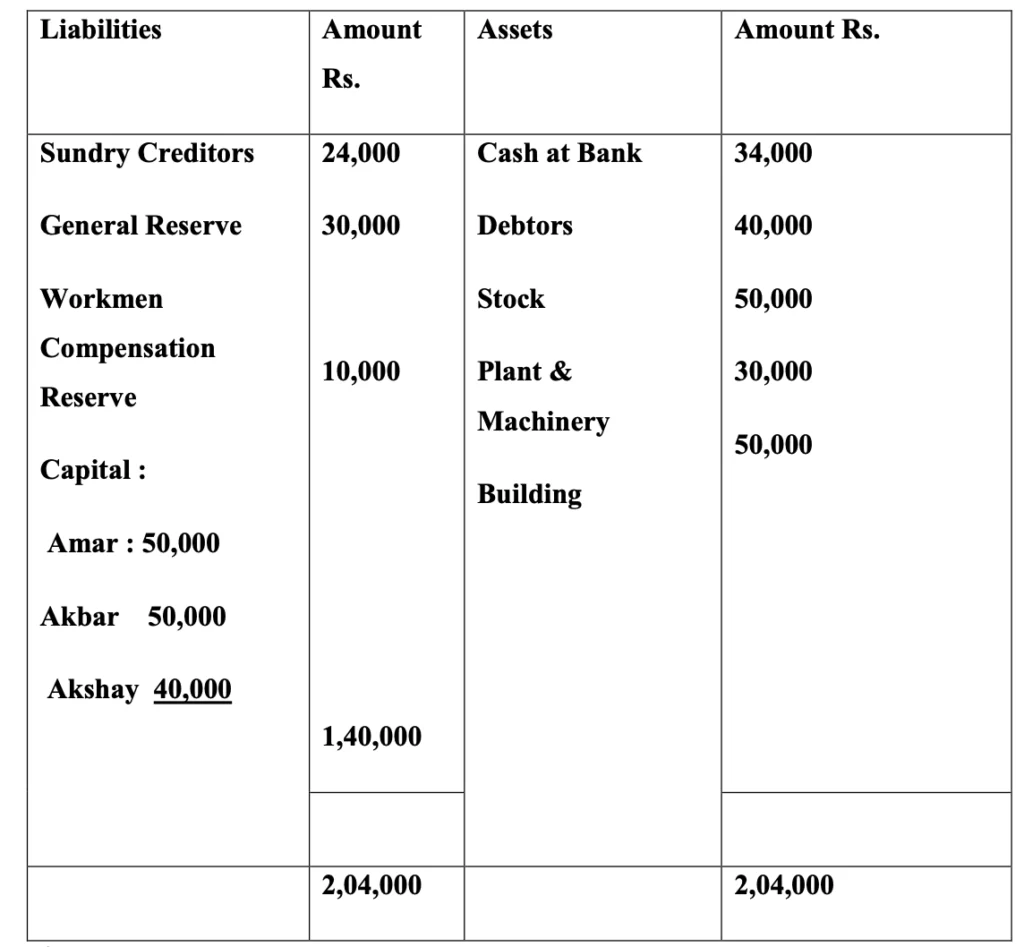

25. Amar, Akbar and Akshay were in partnership sharing profits and losses in the ratio 5:3:2. on 31st March 2021, their balance sheet was as follows:

0n 31st December 2021, Akbar passed away and his share was completely acquired by Akshay. In the event of death of a partner the partnership deed inter alia provides the following:

The executor of deceased partner is entitled to get his capital as per the last balance sheet with interest on capital at 10% p.a.

His share in the accumulated profit, goodwill of the firm and estimated profit till the date of death.

The goodwill of the firm is valued at 2 years’ purchase of average profit of past 3 years.

The profit to be estimated on the basis of the average profit of past 3 years.

The profits of the firm for the past three years were:

31.03.2019 Rs. 36,000; 31.3.2020 Rs. 44,000 and 31.3.2021 Rs. 40,000.

During the year 2021 his drawings were Rs. 12,000 and interest calculated there on was Rs. 600. Prepare Akbar’s capital account, Executor’s Account assuming that the entire amount was settled immediately.

26. Reliable company decided to issue 50,000,9% Debentures of Rs. 100 at 10% premium and redeemable at 20% premium after 5 years. These debentures were issued on 01 October 2021. You are required to

(a) Pass entries for issue of Debentures.

(b) Prepare Loss on Issue of Debentures Account assuming there was existing balance of Securities Premium Account of Rs. 2,80,000.

(c) Pass entries for Interest on debentures on March 31, 2022 assuming interest is payable on 30th September and 31st March every year.

PART- B – PRE-BOARD EXAMINATION 2022-23 | CLASS- XII | SUB- ACCOUNTANCY (055)

27. The Balance Sheet provides information about the financial position of an enterprise:

a) over a period of time b) during a period of time c) for a period of time d) at a point in time

OR The quick ratio of a company is 0.75: 0.50. Will credit purchase of goods Rs. 10,000 increase, decrease or not change the ratio? Give a reason in support of your answer.

28. Given that: Opening inventory of Rs 1,20,000 | Purchases Rs 9,00,000 | Return Outward Rs 40,000 and the closing inventory is Rs 20,000 less than the opening inventory, then, Inventory Turnover Ratio is:

(a) 5 times (b) 7 times (c) 8 times (d) 10 times

29. Which of the following is an Operating Activity for a finance company?

(a) Purchase of investment

(b) Dividend received

(c) Interest received on Loan

(d) All of these OR

Paid Rs. 4,00,000 to acquire shares in RY Ltd. and received a dividend of Rs. 40,000 after acquisition. This transaction will result in:

a) cash used in investing activities Rs. 4,00,000

b) cash generated from financing activities Rs 4,40,000

c) cash used in investing activities Rs. 3,60,000

d) cash generated from financing activities Rs, 3,60,000

30. From the following information, determine the inflow of cash from the sale of machinery:

| Particulars | 31-03-2022 | 31-03-2021 |

| Machinery | 5,00,000 | 3,00,000 |

Additional information: Depreciation for the year ended 31-3-2022 was Rs. 50,000 Purchase of machinery during the year Rs. 4,00,000. Part of the machinery was sold at a profit of Rs. 50,000

a) 2,00,000 b) 2,50,000 c)3,00,000 d) 3,50,000

31. Classify the following items under Major heads and Sub-head (if any) in the Balance Sheet of a Company as per schedule III of the Companies Act 2013.

(i) Loose tools

(ii) Long-term Provisions

(iii) Provision for Warranties

(iv) Income received in advance

(v) Capital Advances

(vi) Advances recoverable in cash within the operation cycle.

32. Explain the significance of Financial Statements to ‘Management’, ‘Investors’ and 3 ‘Creditors’.

33. (a) Calculate values of Opening and Closing Inventories from the following information: Revenue from operations: Rs. 6,00,000; Gross Profit 25% of Revenue from Operations. Inventory Turnover Ratio = 5 times. The closing Inventory is Rs. 12,000 more than the opening Inventory.

(b) Quick Assets Rs. 3,00,000, Inventory Rs. 80,000, Prepaid Expenses Rs. 20,000, working capital Rs. 2,40,000. Calculate the Current ratio.

OR The current Ratio of a company is 2:1. State giving rasons, which of the following would improve, reduce or not change the ratio:

(i) Repayment of a current liability

(ii) Purchasing goods on credit

(iii) Sale of motor vehicles at a profit of 10%.

(iv) Sale of goods at a profit of 10%

34. Read the following hypothetical text and answer the given questions on its basis. Profit for the year ended 31-03-2022 of AB Ltd. was Rs. 10,00,000 after accounting for the following:

| Particulars | Rs. |

| Amortization | 50,000 |

| Profit on sale of marketable securities | 10,000 |

| Interest in investment (long-term) | 15,000 |

| Tax Refund | 10,000 |

(a) 8% Preference shares were issued on 01-04-2021.

(b) interim dividend during the year ended 31-03-2022 was Rs.50,000. You are required to:

1. Determine Net Profit Before Tax and Extra ordinary items.

2. Determine Operating Profit before working capital changes.

3. Determine Cash flow from investing activities.

4. Determine Cash flow from Financing Activities.

5. Determine increase/decrease Cash and Cash Equivalents.

Click Here to Download CBSE Class 12 Accountancy Marking Scheme

CBSE Class 12 Accountancy Sample Question Paper 2022-23: Accountancy Question Sample Paper for the academic year 2022-23 for class XII (Class 12) has been released. All Subjects CBSE sample papers and their marking schemes for the current academic year are available in pdf format on the official website of the CBSE – Central Board of Secondary Education.

Edudel Latest Support Material 2022-23 for Class 9,10,11 and 12th

CBSE Maths Sample Test Paper for Class X – Board Exam 2023

Test Paper Source: KENDRIYA VIDYALAYA

CBSE Sample Papers | CBSE Circulars | Quizzes | Study Material

Join our Premium Telegram and Whatsapp Channel for More News and Updates

For the Latest Educational News (CBSE, ICSE, and State Board News) and live news updates, like us on Facebook or follow us on Twitter and Join our Premium Telegram Channel. Read more on Latest Exams & Results News on Shikshapress.com.